This, in turn, can improve a company’s cash flow and reduce the risk of bad debts. By monitoring the changes in the aging schedule due to discounts, management can gain insights into customer payment behavior and the effectiveness of their credit policies. Let’s look at some examples of how sales discount is treated not as an expense account but as a contra revenue account. In these examples, we will see how sales discount as a contra revenue account is recorded as a debit which is contrary to the natural credit balance of revenue.

Sales Discount Journal Entry

On the balance sheet, sales discounts reduce the amount in the Accounts Receivable account. This reflects the actual amount you expect to collect from customers, improving the accuracy of your financial position. This article delves into the peculiarities of accounting for sales discounts, demonstrating how they impact your accounts and financial statements. By walking through the steps of recording sales and applying discounts, we’ll shed light on the specific methods accountants use to ensure financial accuracy and transparency when dealing with sales discounts. Sales discounts will entice customers to pay ahead of time their credit purchases which in turn will improve the collection of a company’s accounts receivable. Sales discounts will allow companies to receive more money earlier at the expense of revenue which will be recognized in the future as time goes on.

Are sales discounts reported as an expense?

This is one of the best ways most of the sellers could improve the cash flow for their operations. The cash flow statement tracks the cash coming in and going out of your business. So if you had $5,000 in receivables and offered $150 in discounts, your adjusted Accounts Receivable would be $4,850. Obotu has 2+years of professional experience in the business and finance sector.

How to Categorize Expenses in QuickBooks Online: Categorize Expenses With Synder Smart Rules

It takes longer to sell real estate than marketable securities and the transaction costs are higher. If the customer does not pay within the discount period and does not take the sales discount the business will receive the full invoice amount of 2,000 and the discount is ignored. If the customer pays within 10 days then a 2.5% sales discount amounting to 50 can be deducted from the sales invoice, and the customer will pay only 1,950 to settle the account. Trade discounts are not recorded as sales discounts and deduct directly at the time recording sales. An example of a sales discount is for the buyer to take a 1% discount in exchange for paying within 10 days of the invoice date, rather than the normal 30 days (also noted on an invoice as « 1% 10/ Net 30 » terms). Another common sales discount is « 2% 10/Net 30 » terms, which allows a 2% discount for paying within 10 days of the invoice date, or paying in 30 days.

Therefore, their debit balance will be the deductions from sales (gross sales) which reports the net sales. Recording sales discounts accurately in the accounting books is fundamental for maintaining precise financial records. When a company offers a cash discount, the journal entries can vary depending on whether the gross or net method is used. The gross method initially records the sale at the full invoice amount, and the discount is recognized only when the payment is made within the discount period.

Is there any other context you can provide?

- For instance, if a company sells goods worth $1,000 with terms “2/10, net 30,” the initial entry would debit Accounts Receivable and credit Sales Revenue for $1,000.

- For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- Businesses often estimate the take rate of discounts based on past customer actions.

- Expenses, on the other hand, also have a natural debit balance; as explained before this is not in any way the reason for sales discount being recorded as a debit.

- Trade discounts and sales discounts are the two main types of discounts in accounting that might occur in businesses.

The disadvantage of this is to the seller as the seller bears the brunt of lower revenue due to sales discounts. Hence, offering a sales discount is like an extra cost for the seller which may seem like an expense that the seller expends. However, that is not the case, offering a sales discount reduces is sales discount an expense revenue and so is treated as a contra revenue rather than an expense. This means that a sales discount is not an expense but a contra-sales account. Learn the proper accounting methods for sales discounts to ensure accurate financial reporting and compliance with revenue recognition standards.

The amount of sales discount is deducted from the gross sales to calculate the company’s net sales and recorded in a separate sales discount account. When a product is returned, it’s necessary to update the records to show that the customer received both the goods and the invoice but hasn’t yet paid. For example, if a customer returns a $100 item, you’d debit the Sales Returns account and credit Accounts Receivable. In this case, the journal entry would debit the Cash account with $980 to reflect the amount of cash received from the customer.

Sales discounts require specialized bookkeeping with precise and detailed records, which may seem rather unusual to those unfamiliar with accounting. Sales discounts are not technically expenses because they actually reduce the price of a product. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

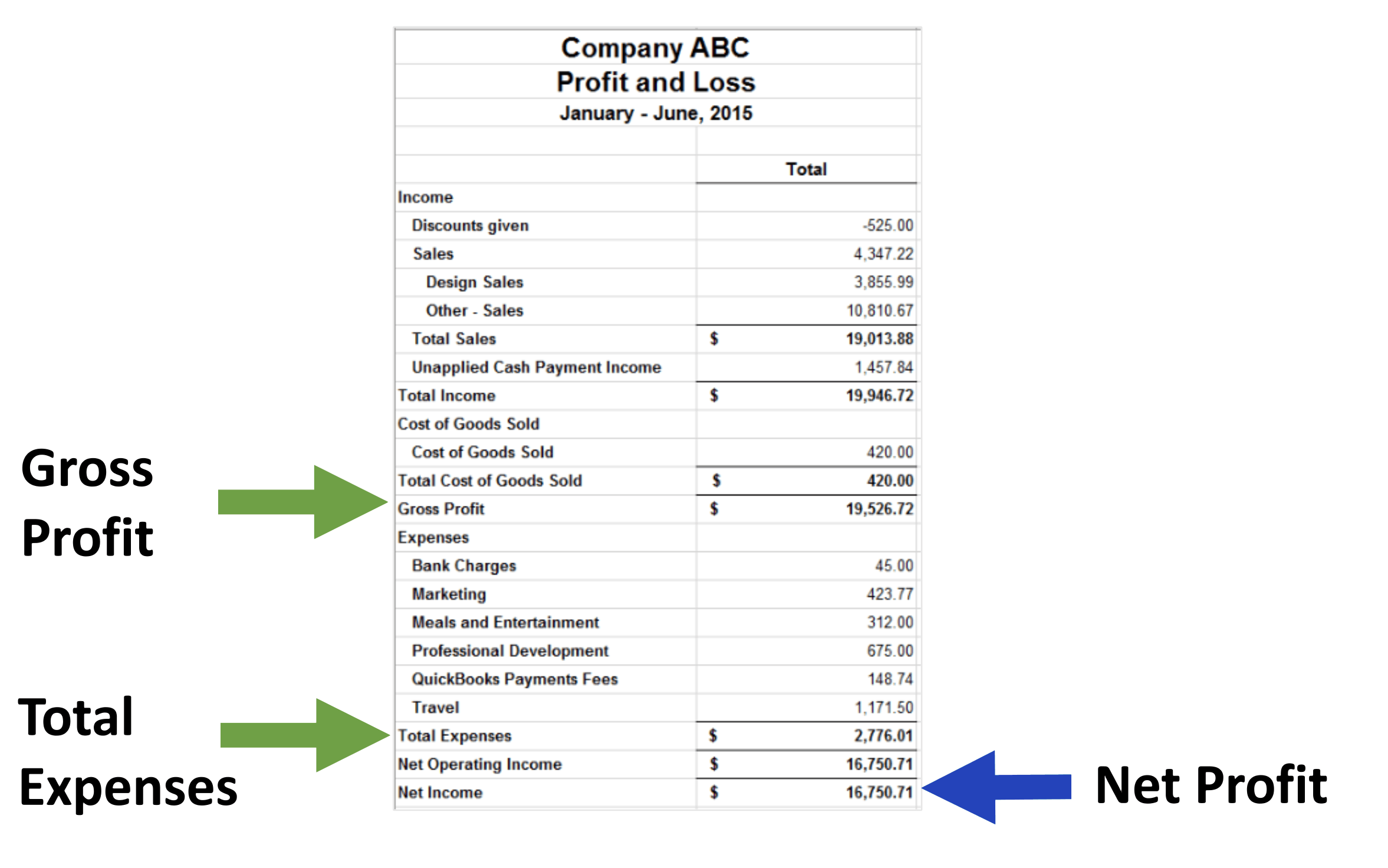

Therefore, the natural balance of a sales discount is opposite to the natural credit balance of a revenue account. As seen in the income statement above, sales discount comes under Gross sales which is in the revenue section, and not in the expenses section. It is usually advisable to use a sales account and a contra-sales account when recording sales. The sale account will report the value of an original sale while the contra-sale account will report the details of any sales discounts, returns, and allowance that reduces the value of the original sale. Companies often categorize receivables based on the length of time they have been outstanding. Discounts taken by customers affect these categories, as they typically shorten the receivable period by encouraging earlier payment.

There is obviously no discount for lack of control for the controlling interest. The bottom line is the same either way but, you are not incurring an expense when providing a discount, you are reducing your revenue. As you can see, full amounts of cash are received and the full amount of account receivables are discharged from the company account. The discount is applicable only if the customer making the payment and the payments are within the term and condition which is within the 10 days. The process involves specific adjustments that ensure transparency and compliance with accounting standards. Understanding how to navigate these adjustments is essential for maintaining accurate books and providing clear financial insights.

While a credit entry of the full invoice amount of $100 would be made to the accounts receivable account in order to remove the invoice amount from the accounts receivable. Sales discounts are a common strategy used by businesses to incentivize customers and boost sales. These reductions in price can help companies manage inventory, improve cash flow, and foster customer loyalty.