Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies essential bookkeeping tips for your photography business and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Reflect on your interview performance and identify areas where you excelled and areas where you can improve.

Technical Knowledge and AR Processes Interview Questions

Both speed and accuracy are integral when taking the accounts receivable assessment test, so remember to read each question carefully while moving quickly within the time limit. They play a critical role in the financial team by managing incoming payments and making sure that all transactions are recorded both accurately and timely. It consists of scenario-based questions that ask candidates to solve common issues when handling accounts receivable. An assessment is the total package of tests and custom questions that you put together to evaluate your candidates. Each individual test within an assessment is designed to test something specific, such as a job skill or language. You can have candidates respond to your custom questions in several ways, such as with a personalized video.

Double Entry Bookkeeping

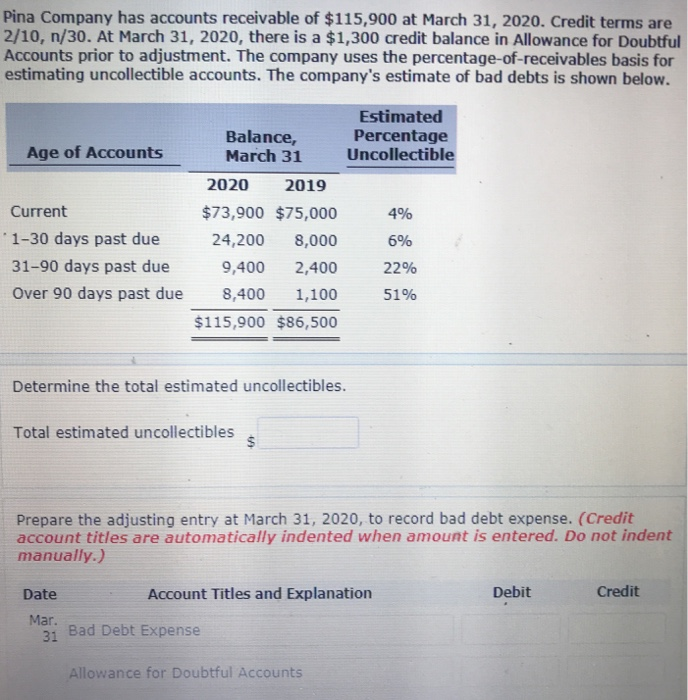

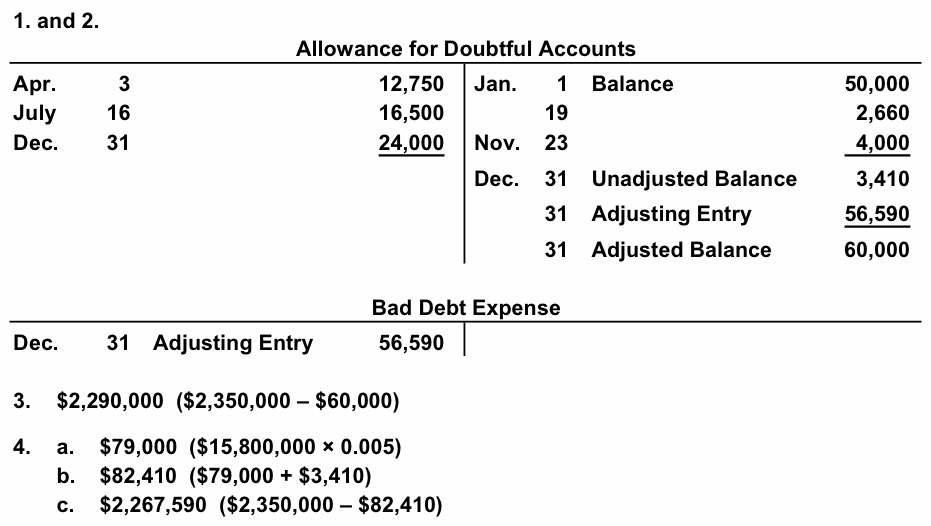

The company uses the % of accounts receivable method to record bad debt expense at the end of the year. For talent acquisition professionals and hiring managers, this guide serves as a valuable resource to assess candidates effectively. With your risk assessment and credit management skills showcased, it’s crucial to demonstrate your knowledge of compliance and legal considerations in the AR domain. An AR interview typically consists of various stages designed to assess your technical knowledge, problem-solving abilities, communication skills, and cultural fit within the organization. These stages may include phone screenings, face-to-face interviews, behavioral assessments, case studies, and sometimes even role-playing scenarios. Each phase presents unique challenges, and we’ll guide you through the entire process to ensure you shine at every step.

Mastering Problem-Solving and Analytical Skills

Now that you’ve demonstrated your knowledge of compliance and legal considerations, let’s explore the importance of teamwork and collaboration in the AR domain. Effective communication and exceptional customer service are integral to success in the Accounts Receivable field. As an AR professional, you’ll frequently interact with customers, colleagues, and other stakeholders. Demonstrating your communication prowess during the interview is paramount. With a solid grasp of technical concepts, it’s essential to showcase your proficiency with accounting software and tools commonly used in Accounts Receivable.

- Let’s delve into the various aspects of teamwork and collaboration during your AR interview.

- The accounts receivable clerk test is crafted for recruiters to identify potential candidates by evaluating their job readiness.

- They are also in charge of managing any issues or discrepancies related to payments.

- Whether you are a seasoned professional looking to advance in your career or a recent graduate venturing into the accounting field, this guide will prepare you for the challenges that lie ahead.

How do you Calculate Days Sales Outstanding (DSO)?

Candidates should also know that the companies who receive the accounts receivable are referred to as “factors” and that they usually ask for a factoring fee as part of the process. Candidates should know that accounts receivable can support small businesses by helping them with liquidity in the short term. If you’re searching for ways to hire a professional with extensive accounts receivable knowledge, there’s a lot to think about. With JobTestPrep, you can take your time using a step-by-step guide or take a timed test that simulates the actual assessment and provides detailed score reports. They are given out to evaluate how well a candidate understands the correlation between allied accounts and accounts receivable.

Accounting Ratios

An unusually high accounts receivable balance relative to revenue may suggest poor collection practices or relaxed credit policies. If Company E has accounts receivable totaling 400,000 dollars against annual revenue of 1 million dollar, this 40% ratio could indicate slower collections, which may impact cash flow. Similarly, if inventory levels are rising faster than sales, there may be an excess inventory issue, leading to potential obsolescence or discounting. These red flags can hint at underlying operational issues or demand constraints, necessitating further investigation into sales and collection processes.

Aspiring leaders should showcase their ability to motivate and resolve conflicts within their AR teams, while also demonstrating resilience in handling stressful situations. Throughout the interview process, candidates are encouraged to provide well-crafted, concise, and structured responses that highlight their skills and experiences. Let’s delve into the critical aspects of risk assessment and credit management in the Accounts Receivable process. Demonstrating your proficiency in these areas will showcase your ability to safeguard the company’s financial interests. With your problem-solving and analytical skills on display, let’s explore the vital role of risk assessment and credit management in the AR domain.

D. Collecting amounts owed from customers increases cash (debit) and decreases accounts receivable (credit). An accounts receivable ratio refers to the number of collections a company makes throughout an accounting period and how efficiently the enterprise can collect receivables from customers. Accounts receivable assessments are used by many companies to measure applicants’ skills and compatibility. The knowledge and accuracy that accounts receivable clerks need to possess are essential for a business, which is why the test focuses on both aspects.

With teamwork and collaboration addressed, let’s explore the leadership qualities necessary for success in the Accounts Receivable field. Armed with foundational knowledge, you’re now ready to tackle technical and theoretical questions related to Accounts Receivable during your interview. A step-by-step blueprint that will help you maximize the benefits of skills-based hiring from faster time-to-hire to improved employee retention. They may then compare this with negative working capital, which is a term that indicates that an enterprise may not be able to pay off immediate debts with its current assets alone. Candidates who can show a high level of attention to detail when handling large amounts of accounting information may have the skills you’re looking for. They may also mention that doing frequent bank reconciliation makes it easier to check potential errors and notice if there are any extra transactions that went through.